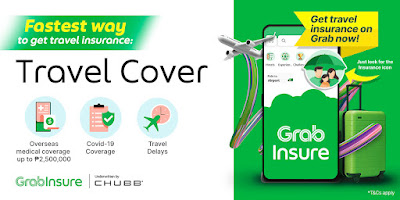

With both international and domestic travel back in full swing, there is simply no stopping the wanderlust calls. Research group The Economist Intelligence forecasts a 30 percent increase in global tourism arrivals in 2023, following a growth of 60 percent in 2022[1]. However, concurrent with the return of tourism is the rise of travel-related challenges such as flight delays and cancellations, unforeseen medical problems, and last-minute plan disruptions. Dedicated to improving the lives of Filipinos via the use of technology, Grab Philippines is equipping traveling kababayans with insurance coverage – a necessary safety net – to protect them against the unexpected while traveling.

With just a few taps on the Grab superapp, consumers can avail of Travel Cover’s extensive coverage that includes domestic and international medical expenses resulting from an accident or illness; expenses related to untoward incidents like casualties and injury; and expenses from taxing circumstances such as trip changes, lost baggage and personal property; and other travel inconveniences. Travel Cover also entitles consumers to COVID-19-related benefits, ensuring they are protected against unexpected medical costs and journey cancellation, or curtailment caused by the illness.3

Country Head of Grab Philippines Grace Vera Cruz shares:

“As we further our commitment to making life better for Filipino through our technology, we are launching Travel Cover– an exciting in-app insurance offering that we are confident will protect our kababayans from unwanted stress or financial loss while traveling. Tourism is flourishing, and we are optimistic meaningful products like Travel Cover will enable Filipinos to take part in the return of travel with greater peace of mind and utmost convenience.”

Travel Cover is now available for purchase on the Grab app. Daily deposits for the new Grab insurance policy go as low as PHP 410[2] for international travel and domestic travel.

Country President of Insurance Company of North America

(A Chubb Company) in the Philippines, Mari Rachelle (Cielo) Canta shares:

“We are very pleased to launch Travel Cover with Grab Philippines as travel rebounds. As a comprehensive insurance plan tailored for leisure or business travel, it enables Filipinos to travel with confidence within and outside of their country. This is the spirit of our partner value proposition at Chubb – to provide innovative and relevant insurance products easily accessed by customers of our partners. Chubb’s digital integration platform, Chubb Studio, continues to orchestrate our embedded insurance alliances with Grab, making it just as easy for Grab to add tailored insurance offers to their digital experiences as it is for its customers to purchase and submit claims.”

Consumers can easily purchase Travel Cover through the following steps:

- On the homepage of the Grap app, click Insurance from the

services featured.

- Choose the Explore tab

where Travel Cover will appear.

Click this and Input the travel details of the travelers.

- Click Get a Quote to

instantly see the cost of the plan.

- Select the profiles of the travelers who’ll avail of Travel Cover and click Next to obtain a summary of the policy before proceeding to Make the Payment.

After these four easy steps, travelers will enjoy peace of mind with their own insurance plan – no additional documents needed.

About Grab

Grab is Southeast Asia’s leading superapp based on GMV

in 2021 in each of food deliveries, mobility and the e-wallets segment of

financial services, according to Euromonitor. Grab operates across the

deliveries, mobility and digital financial services sectors in 480 cities in

eight countries in the Southeast Asia region – Cambodia, Indonesia, Malaysia,

Myanmar, the Philippines, Singapore, Thailand and Vietnam. Grab enables millions

of people each day to access its driver- and merchant-partners to order food or

groceries, send packages, hail a ride or taxi, pay for online purchases or

access services such as lending, insurance, wealth management and telemedicine,

all through a single “everyday everything” app. Grab was founded in 2012 with

the mission to drive Southeast Asia forward by creating economic empowerment

for everyone, and since then, the Grab app has been downloaded onto millions of

mobile devices. Grab strives to serve a double bottom line: to simultaneously

deliver financial performance for its shareholders and a positive social impact

in Southeast Asia.

(www.grab.com).

About Chubb

Chubb is the world’s largest publicly traded property

and casualty insurer. With operations in 54 countries and territories, Chubb

provides commercial and personal property and casualty insurance, personal

accident and supplemental health insurance, reinsurance and life insurance to a

diverse group of clients. As an underwriting company, we assess, assume and

manage risk with insight and discipline. We service and pay our claims fairly

and promptly. The company is also defined by its extensive product and service

offerings, broad distribution capabilities, exceptional financial strength and

local operations globally. Parent company Chubb Limited is listed on the New

York Stock Exchange (NYSE: CB) and is a component of the S&P 500 index.

Chubb maintains executive offices in Zurich, New York, London, Paris and other

locations, and employs approximately 31,000 people worldwide.

Chubb, via acquisitions by its predecessor companies, has been present in the

Philippines for more than 70 years. Chubb in the Philippines is a branch of

Insurance Company of North America, which has been assigned a financial rating

of AA by Standard & Poor’s. The company provides specialized and customized

coverages for Property, Casualty, Marine, Financial Lines, as well as Accident

& Health. It leverages global expertise and local acumen to tailor

solutions to mitigate clients’ risks. With a focus on building strong

relationships with its clients by offering responsive service, Chubb in the

Philippines has become one of the leading providers of Specialty Personal

Lines, Accident & Health insurance through direct marketing.

More information can be found at www.chubb.com/ph

[1] https://www.eiu.com/n/campaigns/tourism-in-2023/

[2] Price may differ depending on the

number of travel days and destination

3 Subject to the full terms and conditions of the Policy.

Like this post? Subscribe to Manila Life by Email